(lead article)

Fed’s 3rd money printing scheme

can’t ‘stimulate’ growth, hiring

|

|

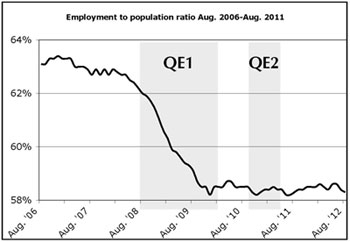

Graph shows percentage of population that is employed and negligible impact of “quantitative easing” programs.

|

BY JOHN STUDER

The Federal Reserve Bank’s third round of “quantitative easing,” announced Sept. 13 by Fed Chairman Ben Bernanke, can be expected to have a similar effect on the crisis of capitalist production, trade and employment as did the $2 trillion put into “stimulating” the economy with QE1 and QE2—none.

Quantitative Easing 3 involves the Fed printing $40 billion a month to buy mortgage-backed securities—at one time commonly referred to as “toxic assets”—from U.S. banks. The stated goal is to lower mortgage costs, spur lending and new construction and promote job creation.

The program, Bernanke said, would be open-ended, totaling $480 billion a year, year after year, until the country’s central bank is convinced “real progress” against unemployment has been made.

Bernanke also said the Fed will continue to keep short-term interest rates close to zero at least until 2015. The idea is to discourage capitalists from parking money in bonds and instead invest in production and hiring, despite the fact that close-to-zero interest rates over the last several years have yet to show any sign of this desired effect.

Bernanke’s announcement, which the New York Times called “a response to the grim reality that more than 20 million Americans cannot find full-time jobs,” had an aura of desperation about it. It comes amid “signs that a double-dip recession of a significant magnitude is in the cards,” Charles Gasparino wrote in the Sept. 13 New York Post.

“The Fed has created all this money in the last couple of years,” Lawrence Kudlow reported in the Sept. 14 New York Sun, pointing to the central bank’s two previous forays into quantitative easing. “But it hasn’t worked: $1.6 trillion of excess bank reserves are still sitting idle at the Fed. No use. No risk. Virtually no loans.”

In addition, corporations themselves have some $2 trillion in cash stashed aside. But still somehow, we’re told, printing more money will “stimulate” bosses to expand production and hiring.

But as the U.S. economy slows down, capitalists have put their money in the stock market and other speculative activity. To the degree they invest capital in production they have focused on “labor saving” speedup designed to squeeze more work out of less workers.

U.S. manufacturers announced that new orders fell to their lowest level since 2009. The Fed’s moves come as “almost every major economy in the world is seeing its manufacturing sector contract,” the Wall Street Journal reported Sept. 20.

Stocks are close to being “more overvalued than they have ever been,” noted fund manager John Hussman in his Sept. 17 circular for investors.

Despite what official unemployment statistics say, there has been no recovery in employment since its plunge leveled out at the opening of 2010. The ratio of employment to population—which unlike unemployment statistics can’t easily be calculated to obscure reality—has remained stagnant. There is no sign that QE1 and QE2 had even a temporary effect of any significance.

However, the increasing money supply can only add to mounting pressures that eventually lead to explosive bursts of inflation with ruinous consequences for working people.

And low interest rates hit the elderly, who depend on interest from savings and pensions, which “are now certain to remain only a tad above zero,” the Weekly Standard reported Sept. 15.

One intended consequence of QE3 is to push down the value of the dollar relative to currencies of Europe, Japan and elsewhere, making U.S. goods cheaper on the world market. “[T]o rekindle the flames of growth in manufacturing,” the Investor’s Business Daily said, “the dollar will have to fall against other major currencies.”

The resulting heightened tension among competing imperialist powers is already evident.

Earlier this month, the European Union’s Central Bank announced it planned to buy up debt from eurozone countries, which is similarly aimed at lowering the relative value of the euro.

The Bank of Japan announced Sept. 19 it would “stimulate Japan’s moribund economy,” the Journal said, “driving down the value of the yen to help the nation’s exporters.”

|