Vol. 77/No. 6 February 18, 2013

While the government has done nothing to create more jobs or increase production, the Federal Reserve continues to pump money into the banks, stock prices are high and government regulations are laying the basis for another round of high-risk housing loans to saddle more working people with debt.

With nearly 23 million workers out of full-time jobs, employment continues to stagnate. According to government figures, 7.9 percent of the workforce was jobless last month, an increase of 0.1 percent from December. And another 6.5 percent were either forced to accept part-time hours or excluded from the workforce as too “discouraged” to be counted.

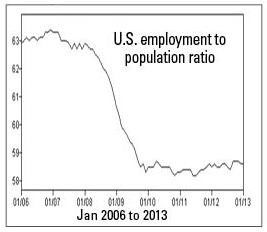

Measuring the actual levels of joblessness is more accurately revealed in the employment to population ratio—a straight percentage of the total population that is employed—which unlike the official employment rate doesn’t lift “discouraged” workers out of the official workforce. In January the ratio measured 58.6 percent, virtually unchanged from 58.5 percent one year ago. In fact, these figures have hovered around this point over the past three years, after a sharp decline of 5 percentage points between 2007 and the beginning of 2010.

Nearly 40 percent of all jobless workers have been unemployed for six months or longer. Millions no longer receive unemployment compensation payments and many more will see them cut off over the coming months.

President Barack Obama disbanded his administration’s jobs council Jan. 31, two years after setting it up. Chaired by General Electric CEO Jeff Immelt, the Council on Jobs and Competitiveness met only four times since its inception—the last time in January 2012.

Instead of hiring additional workers, the bosses’ drive is to boost productivity of those with jobs through speedup, expanded hours and attacks on working conditions. But this drive appears to be hitting some temporary limits. In the U.S., eurozone and Japan labor productivity growth is “virtually stalling,” reported the Conference Board business research group. U.S. labor productivity growth in 2012 dropped to 0.2 percent for the year, down from 0.8 percent in 2011, according to board.

At the same time the U.S. gross domestic product—which measures total goods and services produced—shrank 0.1 percent in the fourth quarter of 2012, its first decline in three years. “For the whole year, economic activity expanded only 2.2% in 2012,” reported the Wall Street Journal, “a fairly meager pace that may be repeated in 2013.” Exports in the fourth quarter declined 5.7 percent.

The Federal Reserve’s current “quantitative easing” measure—the third such endeavor since November 2008—purchases $40 billion a month of mortgage-backed securities from U.S. banks and $45 billion of U.S. government bonds. The scheme, which amounts to printing money, has the stated goal of lowering mortgage costs and spurring lending, new construction and jobs.

While it has done nothing to “stimulate” production or drive down unemployment levels, it has stimulated stock prices and inflationary pressures, which in the long term could have ruinous consequences for working people. Among its real aims is to shore up banks “too big to fail” and lower the value of the dollar relative to other currencies, making U.S. exports more competitive in the world market.

In continuing this program, the Federal Reserve acknowledged its negligible impact. It said the “growth in economic activity paused because of weather-related and other transitory factors,” reported the Financial Times.

Housing construction has risen along with a modest increase in construction employment, a possible product of quantitative easing policies. Subprime mortgages with rates that adjust interest rates higher, are also increasing—up 7 percent last month to their highest level since May 2011. “The Obama administration wants banks to step up approval of such low-income mortgages” and is using its powers under the Community Reinvestment Act to lay the basis to spur this along, reported Investor’s Business Daily Jan 24.

Front page (for this issue) |

Home |

Text-version home