Vol. 77/No. 38 October 28, 2013

|

| Militant |

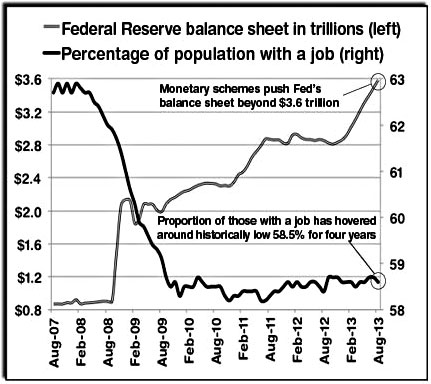

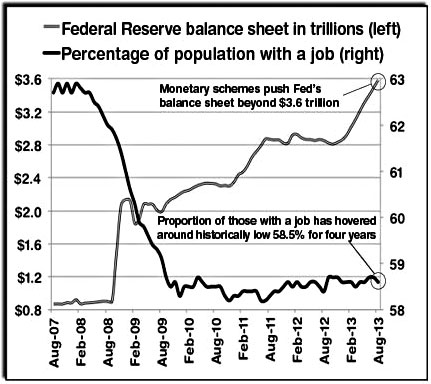

| Percentage of population with job plunged during 2008-2009 recession to around 58.5 percent, where it remains today. At same time, explosion of central bank’s balance shows massive scope of Federal Reserve’s money-printing scheme, promoted as crucial to “stimulate” hiring. |

Yet all evidence points to the conclusion that the monetary fiddling has no effect on bosses’ hiring. The world crisis of capitalism is rooted in a slowdown of production and trade, which is not affected by government policies. Over the past year through mid-2013, world trade volume “has lost its mojo,” remaining virtually stagnant, reported the Financial Times.

Since December 2008 the Fed has maintained interest rates at near zero and through its “quantitative easing” program purchased hundreds of billions of mortgage-backed securities from U.S. banks as well as their own government bonds. As of October it holds $3.7 trillion in its coffers — a 300 percent increase in its balance sheet over the past five years — based on the hope that bosses will borrow the easy money, boost production and hire workers.

But with the slowdown, it’s not profitable for the great majority of bosses to invest in equipment and labor to expand production. Instead, they mostly tend to sit on hoards of cash reserves or seek higher returns through investing it in stocks or other forms of speculative bets, such as on the rise or fall of various kinds of commercial paper.

The one thing the Fed policies could be credited with is postponing some financial crises at the cost of setting up bigger crises down the road. For example, the self-fulfilling superstition that the Fed’s policies increase stock prices have likely promoted stock speculation, propping up those markets further beyond their real value and increasing financial instability. “Collective belief that Fed actions simply make stocks go up, and so they have,” financial analyst John Hussman wrote in August.

Persistently high unemployment

Meanwhile, working people bear the brunt of the economic slowdown, which is still in its initial stages. Lacking control over the root causes of the crisis, bosses are reacting by going after our living standards, working conditions and unions. And they are aided in this endeavor by persistently high unemployment, which they use to foster competition among working people.With the government “shutdown,” the Labor Department has not released its unemployment figures for September. Meanwhile, other polls provide a picture more in tune with workers’ experiences than those cooked up by government-paid statisticians.

“We’ve Got Your Jobless Report,” headlined an Oct. 7 Investor’s Business Daily article. “Unlike the numbers released each month by the Labor Department,” it said, “ours haven’t been crunched, tweaked, twisted, seasonably adjusted or otherwise tortured to tell a comforting story.”

An IBD/TIPP Poll conducted in early October asking, “how many members of your household are currently unemployed and are looking for employment,” reported the numbers unemployed is 47.9 million.

“Out of a workforce of 154 million, that yields a gross unemployment rate of 31%. Among all households, 26% have at least one member looking for work,” reported Investor’s Business Daily.

As the front page chart shows, the disparity between the Federal Reserve’s money-printing programs carried out under the rubric of “jobs creation” and the actual employment situation couldn’t be more stark.

On one hand, the percentage of the population with a job plummeted during the 2008-2009 recession by nearly 5 percentage points to around 58.5 percent, where it has remained for four years — an unprecedented amount of time without any postrecession jobs recovery. On the other hand is an equally unprecedented explosion in the Federal Reserve’s asset balance as a result of its massive money-printing scheme — to the tune of more than $3.7 trillion!

We are reassured the government is going to keep the pedal to the metal with its job-creating monetary policies. Meanwhile, not a single Democratic or Republican party politician has even suggested implementing an actual government jobs program of any kind, as the U.S. rulers did in response to rising workers’ struggles during the later part of the Great Depression. This, unlike monetary and fiscal tweaking, would actually put millions to work building and repairing things workers need — at the expense of capitalists’ profits.

Only the Socialist Workers Party today is raising the need for working people to wage a fight for a government-funded public works program — to help break down the competition between workers and boost the confidence and fighting spirit of the working class.

Front page (for this issue) |

Home |

Text-version home