(lead article)

Fed action kicks up stock

prices as bosses kick us

|

|

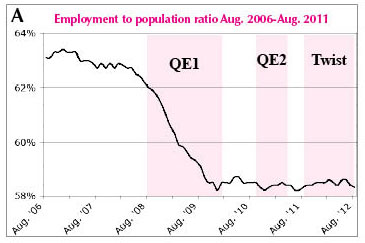

Graph shows percentage of population employed and negligible effect of Federal Reserve’s “quantitative easing” and other monetary schemes. Employment to population ratio is used here because unlike official jobless rate it can’t easily be “calculated” to obscure reality.

|

|

|

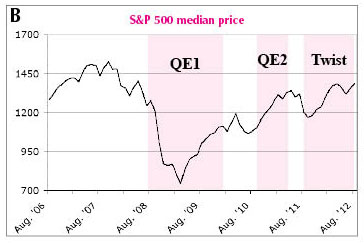

Graph indicates Fed’s monetary fiddling has helped reinflate stock market even further out of whack with actual production, “kicking the can” of financial paper down the road, building up inflationary pressures and paving way for greater crises down the road.

|

|

|

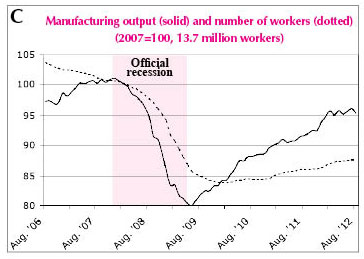

Graph shows relative changes in manufacturing output and number of workers employed in manufacturing, based on 100 representing average levels in 2007. Output has leveled out around 5 percent below pre-recession levels. Widening gap in last part of graph is indication of bosses’ intensification of labor, which has helped capitalists boost short-term profits.

|

BY BRIAN WILLIAMS

More than three years into the so-called recovery, employment levels have in fact remained unchanged since bottoming out at the opening of 2010. The length of this stagnation following a sharp drop is an unprecedented development in U.S. history.

Manufacturing output has barely begun to recover after a drastic decline in 2008. And this is being accomplished on the backs of working people, as increased job speedup and falling real wages are touted as “progress” against “our” competitors in Europe and Asia.

Not to worry: Federal Reserve Chairman Ben Bernanke is cranking the valve wide open on the Fed’s money hose again. This time for an indefinite period. And all without an impediment from some pretence of a democratic-style decision-making process, like a vote from the legislature.

Saying he hoped to “nudge the economy in the right direction,” Bernanke announced Sept. 13 the third round of “quantitative easing,” ostensibly aimed at providing incentives for bosses to expand production and hiring.

With QE3 the Fed will purchase $40 billion of mortgage-backed securities from banks each month on an indefinite basis. These claims on cash flows from payments on mortgage loans are considered of questionable value and hard for banks to sell as more and more people are unable to maintain payments.

This scheme, which amounts to printing money and injecting it into the banking system, will spur the economy we are told. It’s modeled after QE1 and QE2, implemented between November 2008 and June 2011. These measures had no discernable effect on employment, not even a temporary one.

The Fed also seeks to keep short-term interest rates near zero at least until 2015. It aims “to drive down long-term interest rates and push investors into other assets, like stocks,” notes the Wall Street Journal.

Running concurrently with QE3 is the Fed’s “Operation Twist” program, begun a year ago, in which an additional $45 billion is spent each month to purchase long-term U.S. Treasury bonds. This program is scheduled to run at least through the end of the year.

Bernanke argues all this “should spur more spending, investment and exports,” according to the Journal.

But “spending,” or what economists often refer to as “consumption,” can’t be spurred without more jobs and a permanent increase in incomes on a large scale. Printing money can’t help there.

When speaking of “investment” the question becomes investment in what? As the Journal said, Fed policies are primarily driving capitalists to put more money in stocks, driving up stock prices and giving the false appearance to some—workers not among them—that something positive is happening.

Upon the announcement of QE3, the S&P 500 stock index rose 1.6 percent to its highest level since 2007—14 percent since the start of June, reported the Economist. Its inflated levels stand in sharp contrast to the lack of any recovery in jobs and expanding production.

Since the late 1960s, the average rate of industrial profit has been gradually going down. The capitalists have more and more been holding back on expenditures for expanding productive capacity or large-scale employment of labor. Instead, they’re plowing their money into more speculative investments from stocks to other forms of fictitious capital in hopes that bets on rising or falling paper values will yield a bigger return.

On the other hand, huge chunks of cash are increasingly being held by banks and corporations in their own coffers. “The economy’s not short of money,” commented Investor’s Business Daily about QE3. “Banks today have $1.5 trillion in reserves. And companies have $2 trillion in cash stowed away.”

The money hose may temporarily spur U.S. exports, as another goal of QE3 is to push down the value of the dollar against other currencies, making U.S. goods cheaper on the world market.

This approach is tantamount to a declaration of war on the value of the dollar. And Washington’s rivals are responding. Six days after Bernanke’s announcement, the Bank of Japan said it would move to drive down the relative value of the yen. And a similar process is under way in relation to the euro.

The Fed’s money printing “could cause a dollar collapse and spur inflation later,” noted the Journal. While the money hose becomes less and less effective in staving off financial crises, it does pave the way for greater crises down the road.

Look at the charts on this page. Graph A shows the negligible effect of the Fed’s monetary policies on employment. The employment to population figure is used here, because unlike the official unemployment rate, it can’t be falsified by simply lifting “discouraged” workers out of the official workforce.

Graph B indicates that those policies have helped to spur a rebound in stock prices to their pre-recession levels, which means they are even more inflated relative to actual production than before, paving the way for harder falls.

Graph C shows the partial recovery in manufacturing has not led to any substantial hiring. The widening gap between output and employment at the end of the graph is one indication of the bosses’ successful “productivity” drive to squeeze more out of each worker, while tens of millions remain jobless. This, along with the assault on wages, like the expanding multi-tier pay rates in auto plants and other factories, is the only substantive development for the capitalists’ so-called recovery.

It’s through such assaults on the working class that the U.S. rulers seek to become more competitive against their rivals as they drive for markets and trade—a race to the bottom with no end.

This “boom would be based on the continued decline in US unit labour costs,” noted a Sept. 24 Financial Times column. “By 2016, according to Boston Consulting Group, the gap with China would have narrowed to just seven cents an hour.”

|