Rising prices on food, energy, rent and other necessities are upending the lives of millions of working people. Claims by government economists that this is just temporary are wearing thin.

The government aids the bosses by making inflation appear lower and less damaging than it really is. For example, the Federal Reserve frequently uses “core inflation” that excludes food and energy costs, claiming these items are too “volatile.” But it’s precisely these items, along with housing and utility bills, that make up a huge proportion of workers’ expenses.

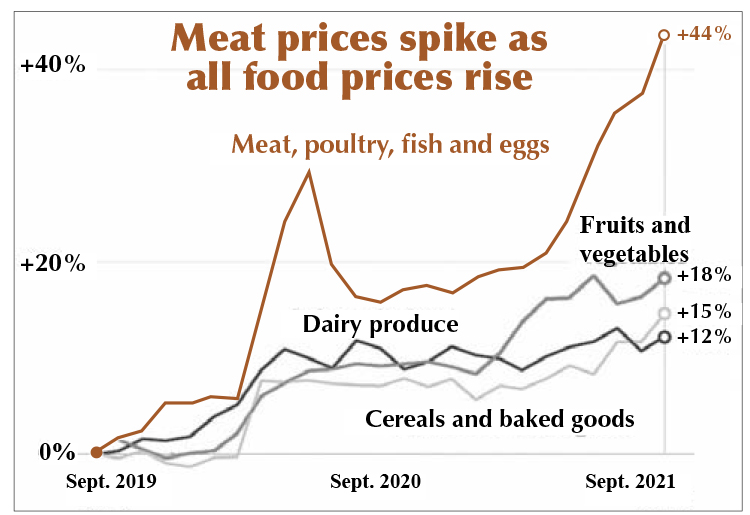

Meat, poultry, fish and eggs are up 44% at supermarkets since September 2019. The Financial Times “breakfast indicator,” based on futures prices on world trading markets for coffee, milk, sugar, wheat, oats and orange juice, has shot up 63% over the past two years. Oat prices have doubled this year alone.

Gasoline costs have risen almost 60% from a year ago. Workers with houses heated with natural gas — almost half — could see bills rise by 30% this winter, according to the federal Energy Information Administration.

More workers today are using our unions to fight boss attacks and to prevent real wages from plummeting. They are demanding serious wage increases and cost-of-living clauses in contracts, pointing the way forward for all working people.

“I’ve been making the same wage of $15 an hour over the past two years, but now prices are much higher,” home health aide worker Inmaculada Vargas told the Militant at her apartment in the Harlem neighborhood of New York City Oct. 29. “When I go to the supermarket, I only buy the essentials” for her family of four children. But these are the items that are rising fastest.

Record oil company profits

With increasing oil and gas prices, ExxonMobil and Chevron made their highest profits in years over the third- quarter. They’re not using these returns to expand production but to drive forward their attacks on workers. Since May 1 bosses at ExxonMobil have locked out workers at the refinery in Beaumont, Texas, as they seek to break the union — the United Steelworkers — push to cut jobs and undermine safety. A company victory will pose a serious threat to all oil workers.

“Food is expensive, and when the food stamps are gone, they’re gone,” grocery store worker Tynicole Lewis, who lives on Manhattan’s Lower East Side, told the New York Times Oct. 27. He makes $12,000 a year and depends on these stamps to help feed his diabetic daughter, Lanese. But they’re now running out well before the end of the month, he said.

Like many other workers, Dominic Kapustka, a quality-control technician in Aurora, Colorado, is trying to make up for rising food prices by working more overtime — 65 hours a week instead of 55. “It seems like no matter how much I fill the cart with, the costs go up,” he told the Times.

Rising food prices at the supermarket don’t mean working farmers are better off. In fact, their costs are soaring too. Prices of fertilizers have more than doubled in the past year, and fuel and shipping costs are rising as well.

More workers are lining up to get assistance at food banks, but a number of these have less food available now, especially in some key items like beef. Even dollar stores, a staple for many workers, are raising prices. Dollar Tree is pricing items at up to $5 at some of its stores.

Increasingly the capitalist media describe what’s taking place today as stagflation — a combination of stagnating production at the same time that prices are rising. Such conditions wreaked havoc on the living standards of workers in the 1970s.

U.S. gross domestic product fell sharply to a 2% annual growth rate from July to September this year, down from 6.7% the previous quarter. At the same time, the consumer price index rose by 5.4% in September — the largest rise in 14 years. And it’s been rising at a similar pace for the previous three months. This amounted to a 2% pay cut for the average worker in July, CNBC reported.

“The threat of sudden inflationary explosions is built right into deflationary depression conditions,” writes Socialist Workers Party National Secretary Jack Barnes in New International no. 10. Facing plummeting profit rates and a rise in working-class resistance, “some capitalist governments will panic and simply begin pumping out money in hopes of buffering the shocks.

“When that happens, workers and working farmers get slammed with the worst of both worlds — high levels of unemployment and explosive inflation. Employed workers will see real wages plunge; working people living on pensions will be devastated; and farmers will be hit with a new wave of foreclosures,” said Barnes.

Capitalist governments have been printing money and raising government debts to unimaginable heights — $28.9 trillion in the U.S. as of Oct. 29.

“Central banks of the U.S., Japan and Europe boosted their combined balance sheets by more than $10 trillion since the pandemic started,” reports Bloomberg News. As this money supply far outstrips the output of commodities to purchase, prices rise. This is exacerbated by a bottleneck of goods on dozens of container ships waiting to be unloaded at ports across the country.

Instead of using these vast amounts of money to invest in upgrading manufacturing facilities and creating new jobs, or stepping up production to make things workers need, the capitalist class finds it’s more profitable today to speculate on fictitious capital like stocks and bonds or on bets on bitcoins and other cryptocurrencies.

In the 1970s, cost-of-living adjustments to match rising inflation were a common feature of union contracts. In 1976 more than 60% of U.S. union workers were covered by collective-bargaining contracts with COLA provisions. By 1995 the share was down to 22%. Bosses have targeted and eliminated COLA from many contracts, and our unions have gotten weaker.

Strike battles fought by workers at John Deere and Kellogg’s, coal miners at Warrior Met in Alabama and other labor struggles point the way to strengthening our unions. As we do so, workers need to fight for cost-of-living adjustments in all contracts and for all pensions and benefits.