The working class continues to feel the squeeze from high prices and challenges getting decent, well-paid full-time jobs to cover their families’ increased living expenses. This reflects the growing capitalist economic and social crisis affecting our lives every day.

But this is not the situation for the capitalist ruling families and their upper-middle-class backers that think Bidenomics is working just fine for them, as they reap profits off high stock prices, investment in gold and other speculative endeavors. The reality of life in the U.S. is sharply class-divided.

The Federal Reserve crows that U.S. household net worth soared to a record $161 trillion in the first quarter of 2024, mostly on the back of rising equity prices. But a closer look shows that the richest 1% in the country own 50% of all equity wealth, and the top 10% hold some 90%. Workers don’t make the cut.

“Economic Data Paint a Picture of Two Americas” headlined a June 8 Wall Street Journal article, pointing to the reality of this class-divide. “The rich are feeling confident but lower-income households are growing cautious.” The paper says that workers shopping for groceries are “struggling with inflation,” while “cruise lines are booming.”

The official unemployment rate for May was 4%, but among 20- to 24-year-olds, it was nearly double that. And job openings fell to their lowest level in more than three years. In fact, the rate at which companies hire workers has fallen to levels last seen seven years ago.

Of the 272,000 jobs the government announced were created in May, the biggest numbers by far are in “leisure and hospitality,” with lower wages, part-time hours and little or no benefits. By contrast, the entire goods-producing manufacturing sector of the economy added just 25,000 jobs in the same month.

Of the 272,000 jobs the government announced were created in May, the biggest numbers by far are in “leisure and hospitality,” with lower wages, part-time hours and little or no benefits. By contrast, the entire goods-producing manufacturing sector of the economy added just 25,000 jobs in the same month.

The federal Bureau of Labor Statistics household survey provides a picture of challenges facing the working class. It reports a drop of 408,000 jobs in May compared to the previous month. Over the past year there’s been an increase of only 31,000 jobs. Since May 2023 an additional 750,000 workers were “eliminated” from the workforce because they’ve been unemployed too long.

“Look Under the Hood: Despite Robust Job Report, Biden’s Economy Is a Lemon,” headlined a June 7 New York Sun article. There’s been a steep drop in full-time jobs — 605,000 in May — while part-time jobs rose by 286,000.

Increasing numbers of workers have had to take on a second or third job to make ends meet. That’s risen to 8.4 million workers in May. This leaves little time to spend with your family, or, for that matter, to start one.

Prices limit buying nutritious food

A new poll by No Kid Hungry New York says that 85% of residents in the state report the cost of food is outpacing their income, with parents of schoolchildren and rural households being hit the hardest. Half of those contacted said the first items to go are increasingly costly foods like fresh produce and meats.

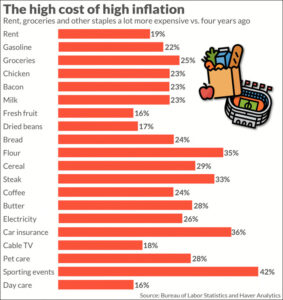

While the annual rate of inflation is lower than a year ago, prices overall are significantly higher than four years ago and they’re not coming down.

Car insurance rose more than 22% since last March, the fastest pace since the 1970s. And further double-digit increases are projected through the end of 2024. Workers’ wages haven’t begun to keep up with these increases.

Rising rents now eat up at least one-third of an average worker’s monthly paycheck, and in a number of cities, like New York, it’s more. That city’s Rent Guidelines Board voted June 17 to raise city-regulated rents 2.75% for one-year leases and 5.25% for two-year, covering almost 1 million apartments. The board imposed similar raises a year ago. Those of us paying market rates have seen them soar higher.

Unaffordable rents have forced growing numbers of young people to live with family members, other relatives, friends or to find like-challenged roommates. And for older workers who don’t have a family to assist them, homelessness is growing.

For workers who would like to buy a home, the costs are prohibitive. Only 5.8% of those renting nationwide — about 2.6 million households — had sufficient income to afford a median-priced home, the U.S. Census Bureau reported. The average 30-year mortgage rate has hovered around 7% recently, up from 3% three years ago. Average home prices are at a record high of $419,300.

People over age 50 are the fastest-growing segment of the population to face homelessness. “These people worked their whole lives, but many were in low-paying jobs with limited ability to have savings or safety nets,” Margot Kushel, director of the Benioff Homelessness and Housing Initiative, told MarketWatch. Any “disruption to job or their health could lead to homelessness.”

These conditions are bred by the workings of the for-profit capitalist system. Neither Bidenomics nor Make-America-Great rhetoric can change this reality. This is why more workers today are joining and using unions to fight for higher pay, cost-of-living protection against the ravages of inflation, and to defend the interests of all working people.

The next step is to break politically with the Democrats, Republicans and all other capitalist candidates and form a party of labor to fight to take political power into our own hands.