|

(front page)

‘Recovery’ not going as

gov’t ‘experts’ expected

Fed’s monetary schemes haven’t created one job

|

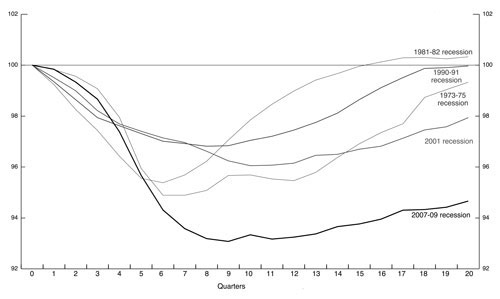

| Nonfarm employment levels from peak in last 5 recessions

|

BY BRIAN WILLIAMS

The current crisis is not only deeper and longer than any other in the last half century, but is not recovering as expected, based on extrapolated models of recent recessions. That’s the conclusion of a Feb. 11 talk by Janet Yellen, vice chair of the Board of Governors of the Federal Reserve at “A Trans-Atlantic Agenda for Shared Prosperity” conference.

In spite of the speech’s title—“A Painfully Slow Recovery for America’s Workers: Causes, Implications, and the Federal Reserve’s Response”—what comes through is the fact that the capitalist rulers and their economic experts can’t really explain the root causes of the crisis and have no control over the natural workings of capitalism that brought it about.

As for the Federal Reserve’s “response,” Yellen points out the Federal Reserve is the only government institution “assigned the job of pursuing” maximum employment and asserts that is what the Fed is working on.

But, while she reviews the Fed’s interest rate manipulations and its money-printing schemes, Yellen doesn’t attempt to show that this monetary-tweaking has created a single job or otherwise mitigated the conditions workers face. Nor does she make a case it has done anything to reverse the slowdown in production and trade at the heart of the crisis.

The fact is it has not, cannot and won’t. Nor, for that matter, can any financial regulations, fiscal fiddling with government budgets or other government economic policy.

The one clear thing that comes through is that the crisis is worse than any in living memory and the “recovery” is much weaker than the “experts” would have thought. “In the three years after the Great Recession ended,” Yellen said “growth in real gross domestic product averaged only 2.2 percent per year. In the same span of time following the previous 10 U.S. recessions, real GDP grew, on average, more than twice as fast.”

Unlike previous recessions, employment levels have not recovered. Long-term joblessness affects millions of workers. One-fourth of all officially unemployed workers have been looking for work for one year or more, and larger number of workers have been laid off, not just temporarily but permanently, from their previous jobs.

No government jobs program

The only thing under the circumstances the government could do—and has done before—to create jobs is to implement a massive government-funded jobs program that could put millions to work building and repairing the infrastructure, hospitals, schools and other things workers need. But not even mention of such a thing is crossing the lips of a single capitalist politician or economist. The only time they have taken such a measure—which ultimately is a drain on the propertied rulers’ profits—was during the latter half of the 1930s and after World War II, under social and political pressure from a fighting workers’ movement.

Today the fiscal policy of the bosses’ government at the federal, state and local level, Yellen says, has been to cut spending and, in some cases, raise taxes. Unlike during past recessions when fiscal policies helped give a boost to recovery, Yellen surmises, “fiscal policy this time has actually acted to restrain the recovery.”

Yellen said she “was relieved that the Congress and the Administration were able to reach agreement on avoiding the full force of the ‘fiscal cliff’ that was due to take effect on January 1.”

What did the deal accomplish? It raised payroll taxes on working people, while putting off until March 1 spending cuts of $110 billion.

Now as this new “sequester” deadline looms, new cuts in social expenditures will affect working people, and if anything, add pressures that lead to contraction.

“The Federal Reserve typically plays a large role in promoting recoveries by reducing the federal funds rate and keeping it low until the economy is again on solid footing,” according to Yellen. But in this “recovery,” she noted, “lower interest rates may be doing less to increase spending.”

Since December 2008 the board has maintained interest rates at effectively zero, on the premise that this would encourage borrowing by businesses to invest in expanded plant, equipment and labor. But with their industrial rates of profit under pressure, capitalists have instead been hoarding cash and investing in non-productive speculation, further destabilizing their financial system. In relation to the exploitation of living, productive labor, the bosses have focused on squeezing greater profits through speedup and increased “productivity” from fewer workers.

In a further move supposedly to spur investment, the Federal Reserve launched its “quantitative easing” program. This scheme, which amounts to printing money, involves purchasing mortgage-backed securities and Treasury bonds. Between 2008 and mid-2011, this operation transferred $2.3 trillion into the Fed’s coffers, Yellen said. Currently $85 billion of this debt is being added to the Fed’s balance sheet each month.

“Some worry,” says Yellen, that the Fed’s policies “will have little effect on unemployment and only serve to stroke inflation.” Indeed, over time, it will.

These moves, far from creating or “stimulating” the creation of jobs, ultimately serve to redistribute the surplus wealth created by working people to the advantage of the largest and strongest capitalists, who put the squeeze on weaker capitalists and above all target working people.

|