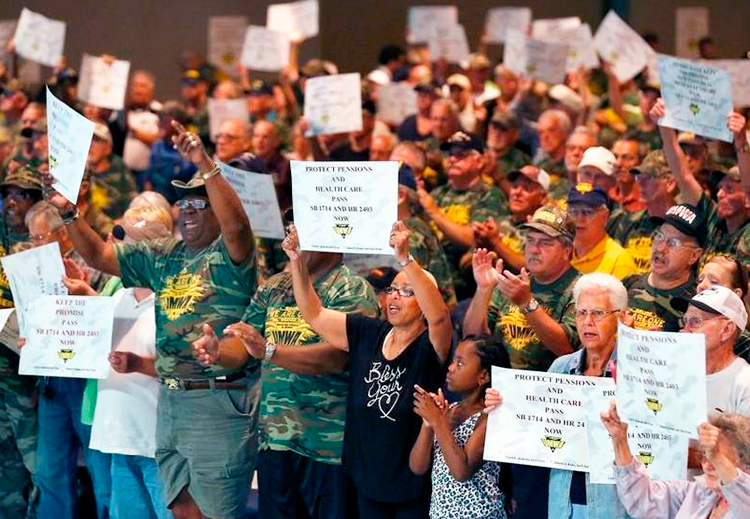

Car caravans and busloads of active and retired union members from across the Midwest and beyond are gathering in their thousands at the Ohio state Capitol in Columbus July 12. They’re demanding that the government fund the pensions for hundreds of thousands of workers who depend on plans on the brink of bankruptcy.

The rally — set the day before a meeting there of Congress’ Joint Select Committee on Solvency of Multiemployer Pension Plans — underscored the need for the union movement to champion the fight for government-guaranteed pensions for all workers at union-scale pay. More than 600,000 retired and working members of several of the unions organizing the rally — the United Mine Workers, the Teamsters, and the Bakery, Confectionery, Tobacco Workers and Grain Millers — belong to plans that face bankruptcy in the coming few years.

“If the pension fund goes insolvent, my pension will go from $4,000 to $1,200,” Sherman Liimatainen, vice president of the National United Committee to Protect Pensions, said by phone July 10. “I’m retired now, but I paid into it for 38 years. The plan affects 400,000 retired Teamsters. Our cuts would be anything between 50 and 70 percent.”

One bus from Duluth, Minnesota, where Liimatainen lives, traveled nine hours to attend the rally.

“Because of health issues many are not able to make it,” he said. “They can’t take such long trips and they can’t take the heat. We expect 10,000 Teamsters, but if all who wanted to could go, there’d be a lot more.”

Phil Smith, communications director with the United Mine Workers, told the Militant July 3 that the union had organized dozens of buses from West Virginia, Kentucky, Pennsylvania, Illinois and Alabama. Miners from as far away as Utah and Colorado are going. Like the Teamsters, the United Mine Workers 1974 Pension Plan is on the verge of insolvency, a move that will affect 87,000 retired and 20,000 working miners.

Retirement is not a ‘fringe benefit’

During the world capitalist economic expansion from the late 1940s through the early 1970s, labor officials steadily retreated from the fighting militancy of the rank and file that had built the industrial unions in the 1930s. The expanding economy of the U.S. rulers, based on Washington emerging as top dog out of the second imperialist war for markets and power, made it possible for workers to win modest, but real wage increases and “fringe benefits” from employers without sharp class battles.

More and more of these pension and health care plans become contingent on the competitive edge and profitability of the bosses.

These benefits weren’t wrung from the government as social protections for the working class as a whole. They are based on the individual capitalist boss or, in the case of multiemployer plans, the union-organized companies in one industry. In good times — for workers who have these plans — they can seem eternal, something workers can count on. But when the capitalists’ profits and world system of exploitation started contracting in the 1970s, this all began to fall apart.

Bosses started to turn on the unions, going increasingly after workers’ wages and benefits. Mines and plants closed, or reopened nonunion. And in 2008 a big financial crisis dealt a blow to capitalist production and trade worldwide. As plants closed, pension plans had less and less workers paying in, and the speculation in stocks, bonds and hedge funds that fund administrators used to increase them took a nose dive.

This is the price paid for the union officialdom’s class-collaborationist policy of refusing to fight for the real needs of the working class — wages high enough to cover workers’ real living costs, federally funded retirement and health care, unemployment pay for as long as you’re out of work at union-scale pay. And all this backed by independent working-class action to take political power.

“We explain the need for the labor movement to fight for social rights such as health care and adequate pensions for all working people,” SWP National Secretary Jack Barnes writes in The Changing Face of U.S. Politics: Working-Class Politics and the Trade Unions. “The unions should take the lead in resisting the continual drive by the government and employers to make meeting these life-or-death needs the responsibility of individuals and their families.”

“Our fund was driven towards insolvency under the oversight of the federal government with investment management by Wall Street companies,” Liimatainen said. “Members of Congress knew funds were failing. But they didn’t offer any solution. Instead, they sucker-punched us with the Multiemployer Pension Reform Act.”

The act, passed by Congress in December 2014, allowed the managers of pension funds deemed to be in “critical and declining status” to get permission to slash retirees’ payments as much as needed to keep the fund “solvent.”

“As authorized by the act, the leadership of our fund proposed a ‘rescue plan,’ that would have slashed our pensions,” Liimatainen said. “But when they sought federal approval to ruin our lives, we did what we do best. We organized. We rallied. We proved that we have ‘power in the numbers.’ We stopped the plan. And now we demand a real solution that safeguards our pensions.”