If you go by what the liberal big-business media are saying, the economy is on the verge of a boom, with prices dropping and fears of a wrenching recession fading away. Among a plethora of articles pushing this view include: “Everything’s coming up soft landing,” by New York Times economic whiz Paul Krugman, and “US economy shifts into disinflation mode,” by Reuters.

These articles all credit President Joseph Biden and the big bankers who run the Federal Reserve and set interest rates with pulling this miracle off. None too subtly, they’re plugging for you to vote for Biden in 2024.

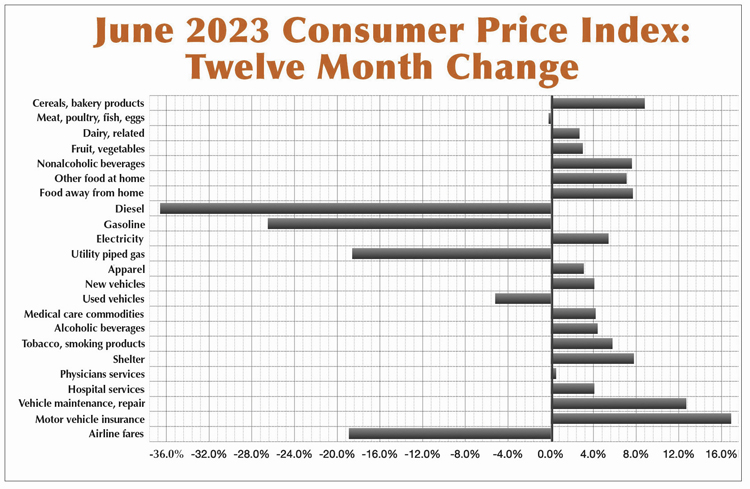

But the facts show the reality facing working people is a far cry from their headlines. While the Consumer Price Index as a whole — which counts everything from yachts and mansions to used cars and rutabagas — has come down in June to 3% over the last year, almost all of this is because of a steep drop in gas and other energy prices.

But this doesn’t mean that prices of goods essential for working people don’t continue to bite us. Rents rose by 8.3% over the past year. Prices for grocery items workers need kept going up — cereals, up 16%; jelly and jam, up 17.5%; mayonnaise, 23%; applesauce, 22%, for example.

Some of the steepest rises were for the cost of insuring a vehicle, up 17% in June. And the cost of keeping your car running rose 12.7% from a year earlier.

Health care prices are eating us up. A study of 72 insurance companies across the country found rate increases of 10% in the works of being implemented. And this comes on top of 20% over the past five years and a whopping 43% over the past 10. Don’t even ask about nursing homes.

And if you want to celebrate the drop in at least some prices — like gas and eggs — drinks at bars and restaurants are up 7.9% in June over last year.

Krugman claims that inflation is much lower if you only count “supercore” items — which don’t include price rises for rents and mortgages, used cars, food and a number of other necessities.

High interest rates make it increasingly difficult for many working people to cover rising credit-card debts, auto payments and home mortgages — now hovering around 7%. As a result, more young adults in their 20s and 30s live at home with their parents or other relatives. They can’t afford to get out on their own or form and maintain a family.

Another sign of this crisis is the huge, unpayable debts being racked up by youths in their 30s in the U.S. Their total balances hit more than $3.8 trillion in the fourth quarter last year, the Federal Reserve Bank of New York reported — a 27% jump over late 2019.

More and more part-time workers

The Biden administration and its boosters pat the Democrats on the back for the low official unemployment figures — 3.6% in June. They say it’s a result of “Bidenomics.” But the fact is real wages have fallen and workers’ purchasing power has dropped since Biden moved into the White House.

And now bosses are indeed keeping more employees on the payrolls, but they’ve been slashing workers’ hours. In June the number of part-time workers increased by 452,000, the biggest monthly jump in nearly four years. A total of 4.2 million workers wanting full-time jobs have had to accept part-time work.

In East Lansing, Michigan, Lawrence Hart-Howlett was forced to take on a second job after his $14.42-an-hour job at the Michigan State University cafeteria got cut from five days a week to two for the summer. He was able to land a second job as a dishwasher at a fast-food chain, but bosses there cut his hours from 24 to 15 a week.

“I had to pick up this job to help cover for my first one, and now what am I supposed to do?” he told the Washington Post. “I’m not sure I’ll be able to cover next month’s rent.”

Bosses and government spokespeople claim that the biggest problem with inflation is it impels workers to fight for higher wages, leading to what they claim is a “wage-price spiral.” This just isn’t true. When workers organize and use unions to fight and win higher wages, it just means profits go down. Profits are what the bosses steal from the fruits of our labor.

The fact of the matter is workers’ real wages are currently 3.2% lower than in December 2020. This has spurred a number of union-led strikes — by the United Electrical Workers at Wabtec in Pennsylvania; Bakery, Confectionery, Tobacco Workers and Grain Millers union at International Flavors and Fragrances in Tennessee; and more — for pay raises to make up for past losses and to keep up with inflation, as well as improved work conditions and schedules.

The 340,000 Teamsters union members at UPS faced a July 31 deadline in their fight for a new contract, seeking to close the gap between what full- and part-time workers are paid. And the United Auto Workers contract with the Big Three auto barons runs out in September.

And while the boss media claim the economy is great, “U.S. manufacturing sector is in a ‘sorry state’” headlined a July 18 MarketWatch article. Industrial output dropped 0.5% for the second month in a row in June, it said. Capacity utilization declined to 78.9%, nearly 2% less than it was last September. Motor vehicles and parts fell 3% last month and utilities output dropped 2.6%. Over the past two months mining output declined 1.6%.